30 Dec What a Long Strange Trip it’s Been

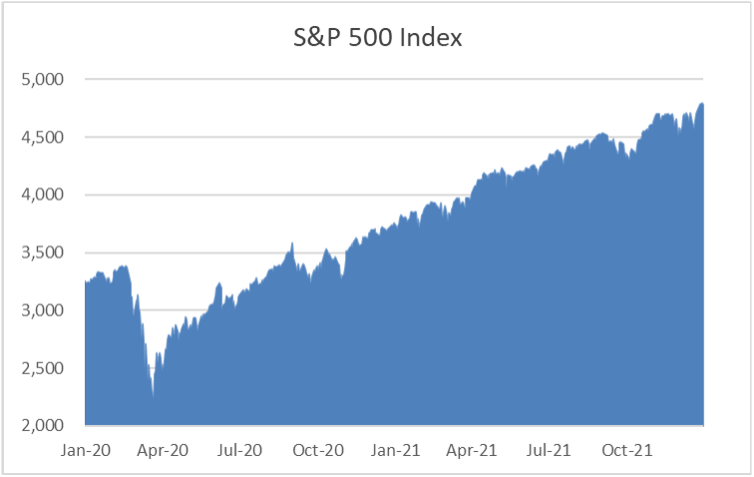

A year ago our market recap covered, unavoidably, year one of the global pandemic. As dismal as the year had been for people overall, it actually ended up being quite prosperous for investors. More importantly, the development of COVID-19 vaccines offered hope that the new year would “bring a gradual return to normalcy” and thereby justify investor optimism. As we wrap up year two of the pandemic, all we can say is what a long strange trip it’s been. Two years on, financial markets continue to boom and people still feel generally miserable about the state of things. While normalcy in our day to day lives remains elusive, the vaccine rollout in developed nations did indeed allow economies to open back up and people to get back to work. Increased economic activity coupled with fiscal and monetary stimulus boosted corporate profits 27% year-over-year.[1] Stock markets cheered the gains with the S&P 500 notching 70 record closes, the most since 1995.

Stocks around the world generally followed suit, with a few notable exceptions. European stocks nearly matched the S&P 500’s performance, but returns for U.S. investors were 10 points lower due to a strong dollar. Emerging markets were a mixed bag. Stocks in Taiwan and India rallied 27% and 23%, respectively, but Chinese stocks lost more than 10% on average, hammered by the state’s crackdown on tech companies and concerns over the property market. In aggregate, U.S. stocks outperformed the rest of the world for the 8th time in the past 9 years. The margin of outperformance, 19 percentage points, was the largest since 1997. All economic sectors gained, but sensitive and cyclical companies in energy, real estate and finance outperformed, while consumer staples and utilities naturally lagged, relatively speaking.

Overall, domestic GDP is expected to have gained 5.5% in 2021. The Federal Reserve is projecting growth of 4% in 2022, which would put the level of economic activity back on its long-term trend rate. Surging consumer demand caught supply chains flat-footed which has contributed to the highest levels of inflation in more than 30 years. The headline consumer price index (CPI) surged to 6.9% in November. Core CPI excluding volatile food and energy prices was 5.0%. Median wage growth also accelerated, to 4.7%, but with it lagging inflation it’s understandable that many consumers feel no better off.

Overall, domestic GDP is expected to have gained 5.5% in 2021. The Federal Reserve is projecting growth of 4% in 2022, which would put the level of economic activity back on its long-term trend rate. Surging consumer demand caught supply chains flat-footed which has contributed to the highest levels of inflation in more than 30 years. The headline consumer price index (CPI) surged to 6.9% in November. Core CPI excluding volatile food and energy prices was 5.0%. Median wage growth also accelerated, to 4.7%, but with it lagging inflation it’s understandable that many consumers feel no better off.

The Fed cannot ignore rising inflation, and minutes of their most recent meeting suggest increasing concern. The Fed stopped referring to inflation as “transitory” and indicated it would accelerate the rate at which it hikes rates and curtails bond purchases. The Fed’s “dot plot” now indicates that there may be three rate increases in 2022 versus the one hike previously contemplated. Still, that would bring the Fed discount rate to just 0.875%, a rate that hardly seems commensurate with the inflationary challenge. Implicitly, the Fed must still expect inflationary pressures to subside as supply chains recover from the COVID shock. Whether or not they do will have a significant impact on Fed policy, interest rates, and prices for financial assets, especially bonds.

Since the release of the Fed meeting minutes, bond prices have sunk and interest rates have surged. Since the end of the year the yield on 10-year treasures has risen from 1.51% to 1.77%. Few analysts expect the trend to reverse. If it doesn’t, treasury bonds will experience their first consecutive year of losses since the 1970’s. In our clients’ fixed income portfolios we have minimized exposure to interest rate risk by keeping bond duration short and keeping a portion of the fixed income allocation in cash or cash equivalents.

Inflation isn’t only a risk for fixed income. Growth stocks have historically suffered when periods of rising inflation lead to higher interest rates. The value of any company’s stock lies mostly in the discounted value of future profits. Relative to the overall market, growth companies have more of their future earnings in the distant future. There is both risk and opportunity cost in waiting for those profits, and both elements increase alongside interest rates. Not surprisingly, as interest rates shot up over the past week, growth stocks in the S&P fell nearly 5%. Value stocks actually gained more than 1%. We expect this trend to continue and in client equity portfolios we remain tilted toward value and away from growth.

As we look further into 2022, inflation isn’t the only concern for markets. The normalcy that we had hoped for a year ago has proven elusive and illusory. While the vaccines have helped the economy approach normalcy, they have fallen short of that goal for how most of us live our daily lives. Insufficient supply in developing countries has given the virus time and space to mutate into what is now its most transmissable version, Omicron. Because Omicron also appears to be less deadly than previous variants like Delta, there has yet to be the profound impact on economic activity that we witnessed in 2020, nor do people expect there to be. No one can confidentally predict the evolution of such a virus, but the markets seem to believe that COVID and any of its future variants will pose no more than a highly inconvenient but manageable problem, economically speaking. Let’s hope they’re right.

[1] St. Louis Fed quarterly profits after tax as of Q3 2021. Profits of companies in the S&P increased 34%.