18 Jul Stocks defy reality

In the face of a grim economic reality, stocks around the globe rose strongly during the second quarter. The Dow Jones Industrial Index surged 18%, its best quarter in 33 years. Consumer discretionary (e.g., Amazon.com) and technology shares (e.g., Microsoft & Apple) again led the way and are the only sectors of the market to produce gains so far in 2020. Consumer and tech companies in foreign markets also performed well, but those sectors represent a smaller share of exchanges outside the U.S., so foreign stocks slightly lagged.

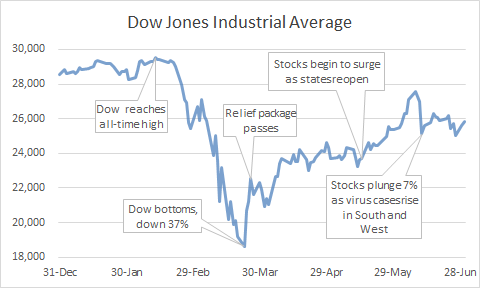

The rally came in two distinct phases. The first was a relief rally precipitated by unprecedented fiscal stimulus in the form of the CARES Act and intervention by the Federal Reserve. Over a three week period beginning in late March stocks rose 30%. Markets generally traded flat to down for the next month as coronavirus cases and deaths rose, especially in the northeastern US and Europe, and as the global economy remained largely closed. Grim economic data piled up, with the unemployment rate rising to 14.7%, the highest since the Great Depression. The second phase of the rally was based largely on optimism. It coincided with the partial reopening of economies in Asia and Europe and in southern and western states that had not (yet) been hit hard by the coronavirus. Stocks rose more than 15% in this phase, leaving the Dow & S&P 500 down only 3% for the year. The hopefulness proved short-lived, however, as the growth rate in new cases of the virus rose at alarming rates in Texas, Florida and even California. Stocks dropped more than 5% at the end of the quarter.

As of this writing, stocks have posted gains in six straight sessions, raising the possibility we are entering a new phase of the rally. If so, it would be the most curious yet, lacking any obvious catalyst. An emerging theory is that massive fiscal stimulus is flooding financial markets with liquidity (cash) which, rather than being spent, is finding its way into stocks. Even day-trading seems to be back in vogue, with sequestered retail investors helping to drive shares of profitless companies like Tesla and Shopify to fantastic valuations. It suddenly seems like the 1990’s, without the prosperity.

Stock prices are always supposed to be forward-looking, but the extent to which the market rally has diverged from current economic conditions is stunning. U.S. stocks trade at more than 20 times 2019 earnings, an historically high multiple, and few are willing to venture a guess as to how far profits will fall in 2020. For market prices to be justified on these fundamentals, we probably need to see something like a V-shaped recovery – a fast and strong rebound that brings the economy back to “normal” before much permanent damage has been done. To attain that, economies need to reopen quickly. But events in the U.S. and elsewhere prove that reopening aggressively leads to poor health outcomes, which cause people to retreat from their normal activities, thereby arresting any economic recovery. Given the experience with the haphazard start and stop approach, it would be reasonable to expect that a blueprint will emerge for careful, phased re-openings that lead to better economic and health outcomes. (Some would argue that this blueprint already exists, it just isn’t being consistently followed, with Vermont being a notable exception).

Either way, this virus is proving to be a tough adversary, making a V-shaped recovery look increasingly unrealistic. A decent semblance of normalcy in people’s daily lives and in the economy appears to await an effective treatment or vaccine against COVID-19. Experts tell us there is cause for optimism. But optimism is a perspective not a plan. Financially, it’s prudent to exercise caution to be able to withstand a longer period of retrenchment. As we do, we will remain hopeful that soon our kids will be back in school, we will be catching a show and dining out with our family and friends.