26 Jul In the Fed We Trust

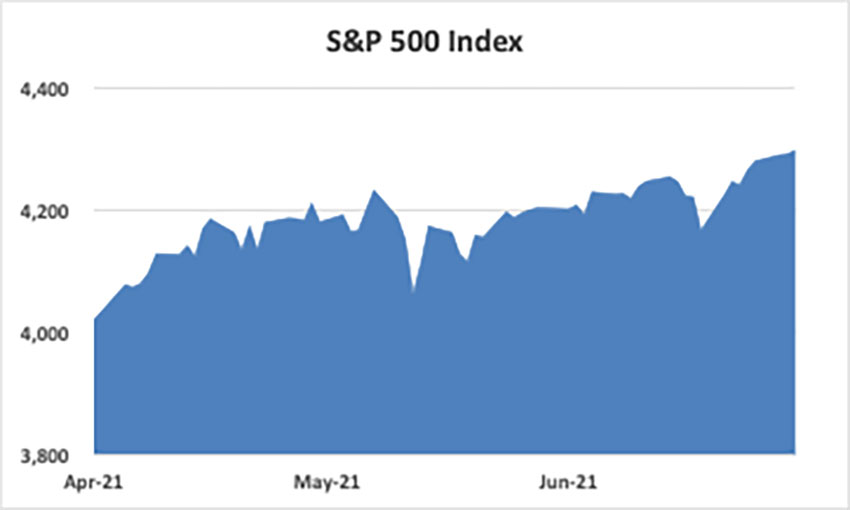

Stocks continued to post gains in the second quarter as the global economy took tentative, uneven steps toward recovery. The S&P 500 index’s fifth consecutive quarterly gain was not without its anxious moments. In mid-May stocks sold off as higher than expected inflation led investors to fear that the Fed might be forced to raise interest rates sooner than it would like. Jerome Powell and other members of the Federal Reserve Board sprung into action, arguing forcefully that these inflationary pressures reflected “transitory” supply shocks. The data seemed to back them up, with much of the headline inflation reflecting significant jumps for relatively few goods like lumber and used cars. Within days, stock markets resumed their upward trajectory and volatility fell back to pre-pandemic levels. Even lumber prices have started to plummet.

With the prospect of higher rates seeming more distant, growth stocks took back their market leading position, gaining 12% in Q2 against just 5% for value stocks. Enthusiasm for smaller companies, which should gain disproportionately in a recovering ecomony, also ebbed a bit, with the Russell 2000 index adding 5% compared with a nearly 9% rise in the S&P 500.

The Fed’s calming influence also brought relief to bond markets. Investors bid up prices, causing yields to fall for the first time in nearly a year. Rates across the spectrum remain miserly, and spreads – the premiums that borrowers pay for default and interest rate risk – have collapsed to historic lows. Cash has never been a more sensible investment, as the opportunity cost of holding it has never been lower, relative to bonds.

The Fed’s calming influence also brought relief to bond markets. Investors bid up prices, causing yields to fall for the first time in nearly a year. Rates across the spectrum remain miserly, and spreads – the premiums that borrowers pay for default and interest rate risk – have collapsed to historic lows. Cash has never been a more sensible investment, as the opportunity cost of holding it has never been lower, relative to bonds.

Investors have clearly concluded that we are in the very early days of an economic recovery that has lots of room yet to run. While jobs gains and GDP growth have been impressive, both employment and economic activity remain below pre-pandemic levels. As yet, only two-thirds of jobs lost have been regained, with leisure and hospitality only recently picking up. Meanwhile, demand for workers has surged faster than their supply, with an army of potential workers remaining on the sidelines. While some point to the $300 monthly unemployment supplement as the key obstacle to restoring employment, the fact that other countries are experiencing similar circumstances suggests that lingering COVID fears may be the more dominant factor. Either way, reluctant workers will eventually re-enter the workforce, and the most recent government employment report suggests that may already be happening. Despite an increase of 850,000 jobs in June, the unemployment rate ticked up as the number of job seekers rose by even more.

Both President Biden and the Fed have prioritized sustained growth in wages at rates above inflation, a necessary condition to improving the standard of living of most people, yet one that has mostly eluded the economy for decades. To achieve this objective the President has proposed increasing the minimum wage, supported trade unions, given preferential treatment to government purchases of American-made goods, and pitched a massive infrastructure package, which now looks likely to pass in some form. The Fed, for its part, has been accommodating. It has kept interest rates low by purchasing massive quantities of government and corporate bonds and staking out a clear position that it will tolerate rising inflation over the next two years. It remains to be seen if the policies being pursued will produce the desired results. For now, markets seem to be betting that they will.