18 Apr Covid-19 changes everything

Just weeks into the new decade, the financial prosperity and tranquility that had prevailed for most of the previous decade was shattered. The culprit was none of the risks pondered so often and by so many; not military conflict nor a trade war, not too much debt nor another financial crisis. A novel coronavirus called COVID-19 originating from inland China has brought the global economy to a near standstill and sent financial markets tumbling. No part of the globe has been spared, and stock markets around the world have fallen by at least 20%.

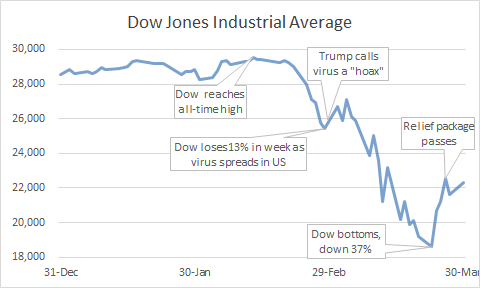

As stunning as the magnitude of the drop in stock values has been, the speed with which it all happened was unprecedented. After reaching an all-time high February 12, the Dow Jones Industrial Average fell 20% in just 20 trading days, the fastest ever plunge into a “bear market” and nearly twice as fast as in 1929. The index then proceeded to fall another 17% in just 9 trading days! Volatility reached levels last seen during the financial crisis. Trading in all sorts of financial instruments went haywire, including ultra-liquid and safe Treasury bonds, until the Federal Reserve stepped in to restore order with a commitment to purchase unlimited quantities of bonds.

Another hallmark of recent events has been the speed of the policy response. In 2008, the failure of venerable investment bank Bear Stearns shook financial markets and kicked off a policy debate within the U.S. Treasury and Federal Reserve. Six months later they were still undecided as Lehman Brothers was allowed to fail, causing the entire U.S. financial system to seize up. Five months after that, Congress finally passed an economic stimulus package – with exactly zero House Republican votes. How times have changed! In action that dwarfs Mario Draghi’s “whatever it takes” response to the European financial crisis, the Fed, within a matter of days, cut interest rates to zero, ramped up purchases of government bonds, and began – for the first time ever – purchasing corporate bonds. Almost as quickly, Congress passed more than $2 trillion worth of Federal relief spending by 96-0 in the Senate and a nearly unanimous voice vote in the House.

The massive and decisive fiscal and monetary response has clearly helped stabilize financial markets. As of this writing on the 6th of April, the Dow is up 20% from it March low. Interest rates, which had spiked as bond prices also fell sharply, have generally stabilized and U.S. Treasury rates are at all-time lows. Yet stock market volatility remains elevated. For all the effect the financial measures have had to date, no one knows whether they will be sufficient to keep the economy from plunging into a deep and prolonged recession. Simply put, this is because no one knows how successful our tentative and uneven health care response to COVID-19 will be in suppressing the disease and allowing people to return to their normal activities.

A clear path back to normal eludes us. There is no real plan and there is no obvious precedent. No president or governor can simply proclaim it. People will return to work and resume dining out, attending shows and traveling when they feel it is safe to do so. We have cause for optimism. Health experts tell us, confidently and credibly, that this will happen. But they suggest it is more likely to be a matter of months than days or weeks. They also tell us to expect the virus to come back and require us to take new, as yet unspecified containment actions when it does. All of this adds up to a considerable amount of uncertainty and anxiety, for financial markets to be sure, but more importantly, for each of us. While the stock market will eventually bounce back, as it always does, it remains more important than ever to focus on the well-being of our family and friends, our colleagues and clients, and ourselves. We wish that you all remain safe, healthy and in good spirits, and we look forward to seeing you again, in person, soon.