18 Oct 2020 Continues to surprise, and not in a good way

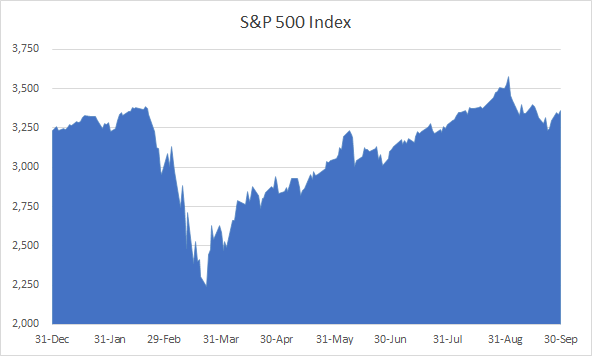

Stocks continued to rally with the S&P 500 finishing 9% higher in the third quarter and up 4% year-to-date. Despite a relatively high prevalence of COVID-19, U.S. markets outperformed those in Europe and Japan. Low interest rates, massive fiscal stimulus and Federal Reserve intervention have provided a boost to U.S. stocks that even a faltering economy couldn’t thwart. In emerging markets, stocks more closely tracked COVID and the economy. Latin America lagged, while South Korea and China surged, aided by extremely low levels of the virus and economies that are mostly reopened. China may even buck the global trend and post modest GDP growth this year.

Back home the job market has failed to achieve a much hoped-for V-shaped recovery. To-date, less than half the jobs lost in the shutdown have been recovered and more than 20 million people remain out of work. The fiscal stimulus that preserved millions more jobs is waning. Large companies have recently announced layoffs across industries as diverse as manufacturing, banking and entertainment, raising the share of job losses that economists consider permanent rather than temporary. It is said that bull markets climb a wall of worry, but this wall is growing taller by the day.

There are signs that investors are starting to take notice. After peaking in early September, the S&P 500 dropped 6% to end the quarter, with tech stocks falling 9%. The breakdown in talks over additional stimulus was clearly a catalyst, but that was hardly the only factor. The rise in COVID cases that health experts have predicted for the fall appears to be materializing and, with the President and many of his closest advisers falling victim to the disease, the ability of the government to function is brought into question. It barely cracks the headlines these days, but the United Kingdom and European Union appear to be headed once again for a hard Brexit. And, of course, November 3 looms over it all.

History tells us not to overestimate the impact of elections on financial markets. Over the long-run, the stock market has performed well under both Republican and Democratic administrations and with both divided government and single-party control. But the short-term impact of this year’s election may be greater than anything we have seen. First, Republicans and Democrats have sharp policy differences. Joe Biden proposes raising the corporate tax rate to 28%, taking back half the cut made in 2017 (when the rate went from 35% to 21%). He has also proposed tax increases targeting wealthy investors. Taken alone, those changes should be a negative for stocks. Whether they can be enacted, however, depends not only on Biden winning the presidency, which experts deem likely, but also on whether Democrats gain control of the Senate, which they consider a toss-up.

The outcome of the election is not the only matter in question. Many worry that there won’t be a clear outcome or, even if there is, that it won’t be accepted by the losing side. The public’s anxiety is palpable – and measurable. Investors looking to hedge their portfolios around the November 3rd election are paying record premiums to do so. In a year that has been nothing but anxiety-provoking, some will be tempted to cash out altogether and wait on the sidelines. Here the last presidential election should prove instructive. Those who sold their stocks then made a huge bet – and lost.

The year 2020 has been extraordinarily challenging and uncertain. Such a time seems to call for a more temperate approach, guided by caution rather than fear, with patient optimism for better days to come.