26 Apr A Change in the Weather

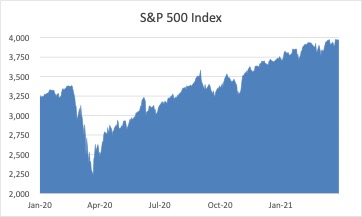

A sense of rebirth accompanies every spring, and rarely has that been so welcome as this year. Following a winter scarred by record numbers of coronavirus cases, a contested election, and a pro-Trump riot at our nation’s capital, the mood of the country has shifted. Cheered by government stimulus payments and an impressive rollout of the COVID-19 vaccine, U.S. consumers have turned more hopeful than at any time during the pandemic. Not surprisingly, a stock market that surged in dark times has continued to rise with the dawn of spring. The S&P 500 finished up 6% in the quarter and has now risen 80% since last March. Impressive as those gains may be, they pale in comparison to shares of small companies, which gained 18% in Q1 and are now 130% above their pandemic low.

Good news for equities tends to be bad news for fixed income, and prices declined across the board for treasury, corporate and municipal bonds. The surge of fiscal and monetary stimulus has some economists concerned about rising inflation, and these worries have shown up in long-term interest rates. Rates on 10-year and 30-year treasuries have risen steadily since last August and now exceed their pre-pandemic levels, even as the Fed has kept short-term rates pinned near zero. For many market analysts, rising interest rates have become the biggest threat to the bull market in stocks.

In the near-term, there may not be much to worry about. History suggests that stocks perform well when interest rates rise from very low levels like these. Provided the economy is expanding, as it is almost certain to do over the next couple of years, higher interest rates reflect a healthy increase in the demand for money that naturally accompanies an economy with consumers eager to spend and businesses willing to invest. The risk to stocks and the economy comes when increasing demand sparks uncomfortably high levels of inflation, generally thought to be above 3-4%. It has been nearly a generation since inflation reached such levels, so long in fact, that many adults have no practical memory of it. The Fed has even taken the extraordinary position that underinflation is now the problem, suppressing wage growth and exacerbating income inequality. It is prepared to let inflation run above 2% for an extended period of time.

In the near-term, there may not be much to worry about. History suggests that stocks perform well when interest rates rise from very low levels like these. Provided the economy is expanding, as it is almost certain to do over the next couple of years, higher interest rates reflect a healthy increase in the demand for money that naturally accompanies an economy with consumers eager to spend and businesses willing to invest. The risk to stocks and the economy comes when increasing demand sparks uncomfortably high levels of inflation, generally thought to be above 3-4%. It has been nearly a generation since inflation reached such levels, so long in fact, that many adults have no practical memory of it. The Fed has even taken the extraordinary position that underinflation is now the problem, suppressing wage growth and exacerbating income inequality. It is prepared to let inflation run above 2% for an extended period of time.

Into this context jumps the next great political debate – President Biden’s inextricably linked infrastructure and tax plans. Much has been and will be written about the details of these plans. As investment rather than political analysts, we are primarily focused on two elements – the prospects for reversing decades of underinvestment in the economy, and the potential for higher taxes on corporations and wealthy investors. It would be too easy to say these are a wash for investors. In truth, the details matter. Intelligently crafted plans might be supportive of future stock prices, while ill-conceived plans could prove destructive. What is both easy to say and likely true is that the political process will be messy, analysts will frequently misinterpret and exaggerate the impacts of specific policies, and financial markets will react to the daily back-and-forth in Washington. Get ready for volatility.

Investors may also need to alter their playbook to the changing climate. Large growth companies that prospered in an era of persistently slow economic growth and low interest rates will struggle to repeat in an era of higher growth and interest rates. Historically, smaller companies in cyclical industries like finance and industrials have outperformed in times like these. We saw some evidence of that last quarter – as small company stocks rallied, the likes of Tesla and Zoom finished the quarter off their all-time highs by 30% or more.

In so many respects the months and years ahead will be unlike any in our collective memories. We may be about to witness a fascinating period of macroeconomic experimentation. There are politicians on both sides of the aisle, supported by the Federal Reserve, that appear ready to take on the issues of chronic underinvestment and exploding wealth inequality. How skillfully they pursue these goals while avoiding negative consequences like inflation, will have a lot to say about how easy or hard it will be for the rest of us to achieve our personal financial goals. We shall monitor these developments and, as always, provide an update next quarter.